Why Incomplete COI Information Leads to Costly Delays and How Centralized Tracking Prevents Them

A project is ready to move forward.

The schedule is approved.

Contractors are lined up.

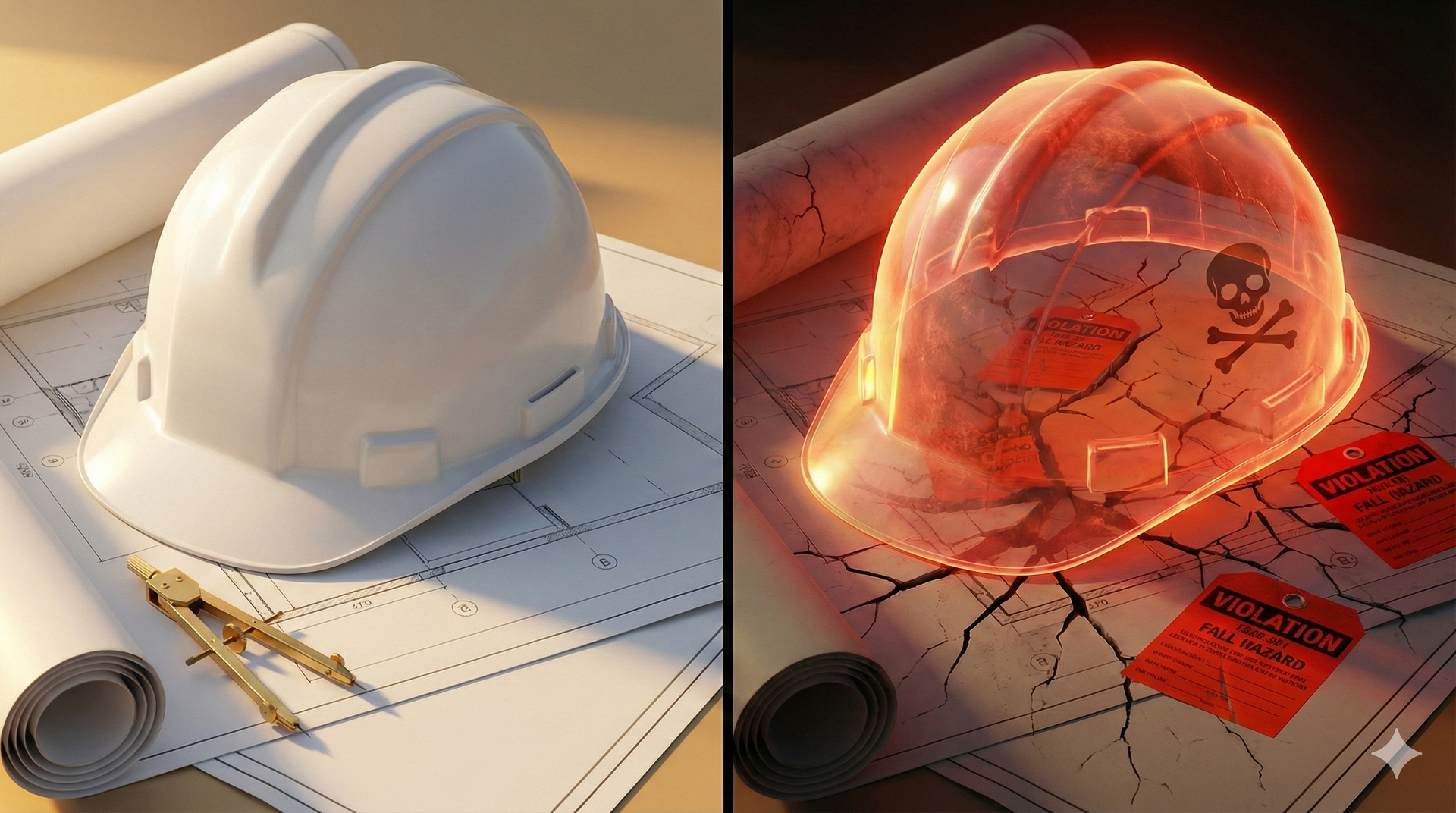

Then everything stops because a certificate of insurance (COI) is missing, expired, or incomplete.

For Safety Directors, Risk Managers, and Operations leaders, this scenario is not hypothetical. It’s a recurring operational disruption that quietly derails timelines, strains internal teams, and exposes organizations to unnecessary risk. Incomplete COI documentation is one of the most common and most preventable causes of insurance-related project delays.

This article explains why COI issues happen so often, how they impact safety, compliance, and operations, and what organizations can do to prevent delays through a structured, centralized COI tracking approach.

Why COI Issues Are Still Causing Project Delays

Most organizations understand that contractors must meet insurance requirements before work begins. The challenge isn’t awareness - it’s execution.

Common COI Gaps That Trigger Delays

Incomplete or inaccurate COIs typically fall into a few predictable categories:

- Expired certificates of insurance that were valid at onboarding but lapsed mid-project

- Missing insurance endorsements, such as additional insured requirements

- Coverage limits that don’t align with contractual or risk requirements

- Incorrect entity names, locations, or policy details

- COIs submitted without required supporting documentation

Each issue creates a compliance gap that must be resolved before work can proceed often under tight deadlines.

The Root Cause: Manual and Fragmented COI Tracking

Many organizations still manage contractor insurance compliance using spreadsheets, shared folders, and email threads. This approach creates risk at scale.

What’s Breaking Down Behind the Scenes

- COIs are collected during onboarding but not consistently tracked afterward

- Expiration dates are monitored manually, increasing the chance of oversight

- Different departments track different versions of the same contractor’s documentation

- Updates rely on contractors proactively sending new certificates

The result is contractor onboarding delays, last-minute document scrambles, and preventable stoppages when compliance gaps surface too late.

The Operational and Legal Impact of Incomplete COIs

Incomplete COI documentation isn’t just an administrative inconvenience - it has real consequences.

For Safety and Risk Leaders

- Contractors may mobilize without verified coverage

- Insurance gaps increase exposure during incidents or claims

- Documentation deficiencies complicate audits and internal reviews

For Procurement and Operations

- Projects stall while insurance issues are resolved

- Start dates slip, impacting downstream schedules

- Internal teams lose time chasing documents instead of managing operations

From OSHA audits to contract enforcement, contractor compliance documentation is foundational. When it’s incomplete, everything slows down.

What Effective COI Management Actually Requires

Preventing delays requires more than collecting certificates - it requires a defined COI management process.

A Practical COI Compliance Checklist

An effective approach ensures:

- COIs are collected before work begins

- Coverage is reviewed against client-defined requirements

- Expiration dates are tracked centrally

- Contractors receive reminders ahead of renewals

- Insurance status is visible at a glance

This is where centralized systems outperform manual processes.

How Centralized COI Tracking Prevents Delays

Centralized COI tracking replaces fragmented workflows with a single, structured source of truth.

What Changes When COIs Are Centralized

- All contractor insurance records live in one system

- Coverage requirements are applied consistently

- Expiring policies are flagged before they become a problem

- Compliance status is easy to confirm across teams and locations

Instead of reacting to issues at the gate or on the jobsite, teams identify and address gaps early before they affect schedules.

FIRST, VERIFY’s Approach to COI Management

FIRST, VERIFY supports organizations by maintaining and tracking contractor insurance documentation as part of a broader compliance framework.

Through its COI management process, FIRST, VERIFY:

- Collects COIs and required supporting documents

- Reviews insurance details against client-defined requirements

- Tracks expiration dates and provides renewal reminders

- Displays insurance compliance clearly within each contractor’s profile

This structure helps teams reduce insurance-related project delays, improve visibility, and maintain consistent compliance documentation management across their contractor base.

Importantly, FIRST, VERIFY does not rely on real-time insurance feeds or predictive analytics. Instead, it provides accurate, centralized documentation that enables teams to manage compliance proactively and with confidence.

Moving From Reactive Fixes to Proactive Control

Incomplete COIs don’t have to be a recurring problem.

When organizations replace manual tracking with a centralized system, they gain:

- Fewer onboarding disruptions

- Clearer contractor insurance compliance

- Stronger audit readiness

- More predictable project timelines

For safety, risk, and operations leaders, this shift isn’t about technology - it’s about protecting schedules, reducing exposure, and keeping work moving.

Ready to Reduce COI-Related Delays?

If expired certificates, missing endorsements, or last-minute insurance issues are slowing your projects, it may be time to reassess how COIs are managed.

FIRST, VERIFY helps organizations centralize COI tracking, streamline contractor compliance documentation, and identify issues early before they become costly delays.

Contact us to learn how

FIRST,

VERIFY can support your COI management process and help keep your operations moving forward.